Buy cheap stocks, or follow the trend? Two conflicting (and often exact opposite) strategies that have both worked well through market history. Momentum, when it’s working well, can be unstoppable for years. When it’s not working, it can lead to horrendous results relative to the market. Value has been steadier, but it too undergoes periods of significant underperformance. So what about combining these two ideas by looking for cheap stocks that the market is just beginning to notice? Think of the combination as the best aspects of the tortoise and the hare.

First, consider the results for a pure value and a pure momentum strategy[i]. Here are the rolling 3-year excess returns of these two strategies (best decile) versus all stocks since the 1960’s.

Notice that momentum is much choppier, but it has three separate 3-year periods when it outperforms by more than 20% per year for three years! Value only reaches that level once.

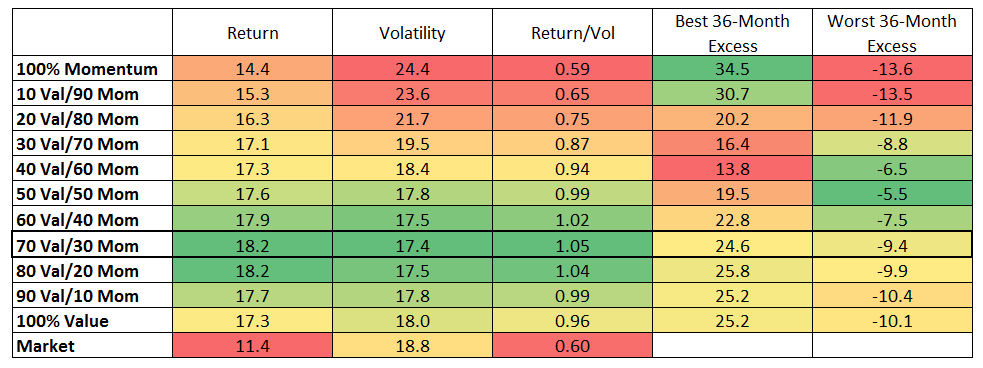

So what if you combined these ideas? I ran a series of tests combining value and momentum into a single factor, giving weights from 0-100 for both value and momentum factors—so, for example, a 50/50 combination gives equal weight to a stock’s momentum rank in the universe and its value rank in the universe. The long-term and rolling results for the best decile portfolios are listed below.

Best decile portfolios, 1/1965-9/2014

Best decile portfolios, 1/1965-9/2014

The best combination, measured by risk vs. volatility, was 70% value, 30% momentum. This strategy focuses on cheap stocks, but avoids those that are still in relative free fall versus the market. Check out the best and worst case 3-year returns for pure momentum. At one point (late 90’s) it outperformed by more than 34% per year for three years (that is more than 140% cumulative outperformance). Of course momentum was terrible during the market recovery following the 2009 bottom, underperforming by more than 13% per year for three years, causing many to abandon the momentum strategy.

In the rolling returns above, you can see that combinations of the two factors are much steadier performers. Value was crushed in the late 90’s, for example, but including some momentum in the mix would have mitigated the damage.

With factor investing all the rage, it’s good to know that both of these strategies work, and that they work at different times. But the most powerful combination is a strategy that measures both value and momentum at the stock level. Both value and momentum have had 3-year periods where they underperformed the market by more than 10% annualized. But the worst case for a 50/50 combination of value and momentum? Just 5.5% annualized underperformance over three years.

Bottom line, the tortoise and the hare both have their merits: cheap valuations rule AND the trend is your friend. Look for stocks that have both.

[i] Momentum is defined as trailing 6-month total return, value is defined as a combination of price-to-sales, price-to-earnings, EBITDA/EV, and Free Cash Flow/EV. The best decile portfolios are rebalanced on a rolling annual basis.

/rating_on.png)

What would be the best way to implement a strategy like this?

Would be awesome for an oil update

Please could you explain what "rolling annual basis" means. Does this mean that you form the portfolios yearly and hold for a year, or what exactly?

I’m curious if you explored a portfolio constructed by ranking one factor and then layering in the second versus a 50/50 weighting. For example, first rank the value factor then take only the highest ranked momentum stocks in the best value decile/quintile. You’d end up with a more concentrated portfolio but it would be interesting to see how would the results differ from what you presented here.

What are thoughts on a blended ETF portfolio of QVAL and PDP? Or would the negative correlation just wipe out any excessive, long-term gains?

both value and momentum work, and work very well in combination. I know Wes (QVAL manager) and respect his work a great deal. I don’t know much about PDP.

Yes that works well too. There are many different ways to apply these factors, and virtually any combination is effective. It comes down to personal preference.

I should do a full post on this methodology so its clear.

the simplest way to think of it is running 12 separate portfolios, one for each month. In each, you buy stocks and hold for one year and then rebalance (so its an annual rebalance for each, rebalancing one of your 12 portfolios every month). Then just average the results across those 12 portfolios and you’d get my results. This method incoporates the most possible information, removes any seasonality, and still keeps a nice 1-year average holding period.

Thank you, much appreciated. I’m also evaluating the Cambria momentum fund, GMOM, as well as waiting for Alpha Architect’s momentum shares to debut.

Hey Patrick,

Just bought a copy of your book for both my 20ish nephews. Hope to get them thinking right early.

I notice that much of your value vs. momentum work uses the same holding period for both strategies when much of the research shows momentum to be a short term (1-3 month) phenomena while values is more regression to the mean (3-5 years). Do you plan to look at the effect of holding periods?

Quill